Two solar companies file for bankruptcy, more may follow

In the past week and a half, two U.S., based solar materials manufacturers, Evergreen Solar Inc. and SpectraWatt Inc. filed for bankruptcy. The filings were made following a second quarter that was dismal for most solar companies as subsidies reduced at the same time that modules flooded the market, forcing manufacturers to lower prices to remain competitive.

In the past week and a half, two U.S., based solar materials manufacturers, Evergreen Solar Inc. and SpectraWatt Inc. filed for bankruptcy. The filings were made following a second quarter that was dismal for most solar companies as subsidies reduced at the same time that modules flooded the market, forcing manufacturers to lower prices to remain competitive.

At least one analyst thinks more companies could follow suit.

One of the biggest drivers for Evergreen’s bankruptcy was the mercurial fall in the price of silicon. When the cost of silicon was high, Evergreen developed a method called string ribbon technology that used less silicon in the manufacturing process.

“Unfortunately for Evergreen, polysilicon prices tumbled, from a high of $475 per kilogram in early 2008 to $52 today,” Bloomberg reported.

SpectraWatt couldn’t compete with inexpensive modules from China, said CEO and Chief Restructuring Officer Brad Walker.

"United States-based manufacturers are under a great deal of stress because of the emergence of manufacturers in China, who receive considerable government and financial support," said Walker.

China has invested $11.5 billion in its solar manufactures recently.

This could be just the beginning of a shakeout in the industry.

“It’s clear that the weaker, less cost-competitive companies are having problems. So, yes, there are a lot of private companies out there that we don’t know the balance sheets of, so it’s hard to say [how they'll do],” said JP Morgan analyst Christopher Blansett. “There are a lot of small private companies trying to participate in the solar PV food chain, and foreign companies trying to get into the playing field. Even competitive companies have extremely poor gross margins right now.”

The fluctuation in solar subsidies across the world is likely to significantly impact the solar industry, according to Blansett.

“The subsidies supporting the industry continue to decline [particularly where they’ve been the strongest, in Europe]. Those countries have driven the majority of demand and profits in the industry so far,” he said. “Those same subsidies are scheduled to decline significantly in Germany and in Italy within the next 12 months. The most profitable region is cutting subsidies at the fastest rates.”

With the potential loss of those subsidies, the industry may face more dire straights.

“Solar’s nowhere near being self-sustaining. When we first launched [coverage] on the sector back in ‘07, we said: ‘No subsidies, no industry.’ We still see that’s true,” Blansett said. “We need subsidization for a number of years before it can stand on its own.”

While some companies may fail, others will are likely to survive the tumult.

“We’re definitely seeing stronger business models float to the top. The companies that have executed well are going to survive longer and do better, and we’ve definitely seen that in Evergreen’s case,” Blansett said. “We’re seeing good and bad business models go in their appropriate directions.”

Evergreen’s plight could have taken a very different route, however, had it done some things differently or if the timing was different, according to Blansett.

“It all depended on what the debt holders were going to do. If [Evergreen] got debt holders to trade debt for equity, the company might not have declared bankruptcy. But [debt holders] weren’t willing to do that,” he said.

Evergreen also may have made its salvo, a move to China, too late. If Evergreen Solar's move to China happened a year ago, they might not be in this position now, according to Blansett.

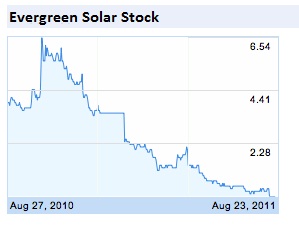

Image excerpted from Google, a historical chart of Evergreen's stock.