Solar companies ship 5.8 GWs of PV in second quarter

New research from NPD Solarbuzz shows that the second quarter of 2013 was a real record-breaker for solar manufacturers. NPD Solarbuzz’ Module Tracker Quarterly report found that module shipments for the 20 leading PV manufacturers exceeded 5.8 gigawatts (GWs) in the last quarter, that’s up 21 percent from the 4.8 GWs of solar shipped in previous year’s second quarter.

New research from NPD Solarbuzz shows that the second quarter of 2013 was a real record-breaker for solar manufacturers. NPD Solarbuzz’ Module Tracker Quarterly report found that module shipments for the 20 leading PV manufacturers exceeded 5.8 gigawatts (GWs) in the last quarter, that’s up 21 percent from the 4.8 GWs of solar shipped in previous year’s second quarter.

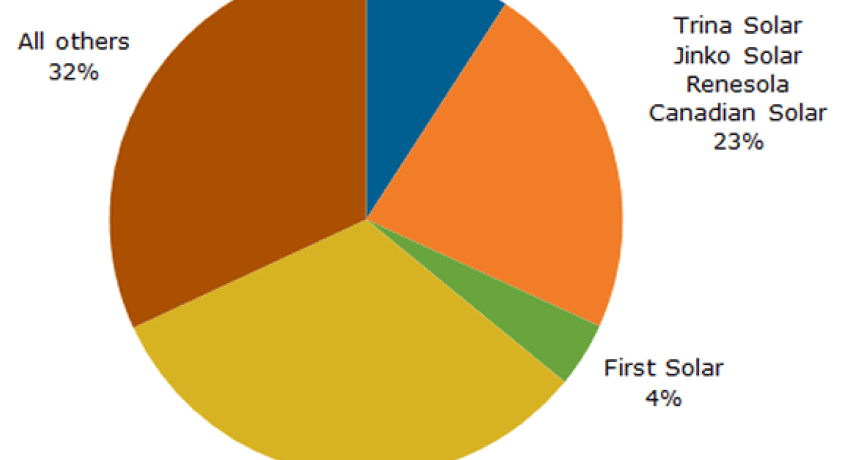

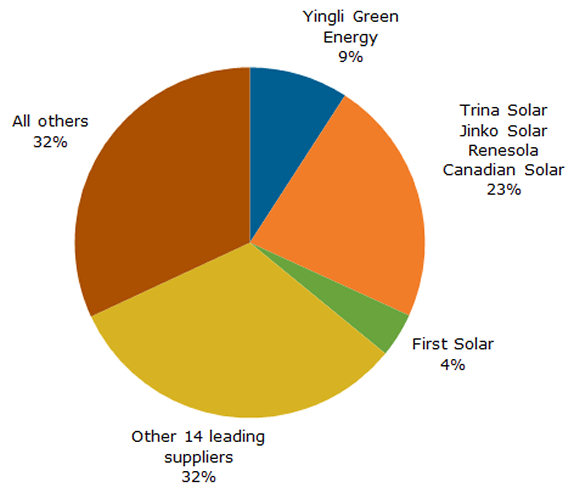

The preliminary results show that Chinese manufacturers significantly led the pack, with Yingli Green Energy shipping roughly 800 megawatts alone. “Yingli Green Energy has been strongly focused on market share gains over the past four quarters,” said Ray Lian, senior analyst at NPD Solarbuzz. “The company is rapidly approaching 10 percent global market share, and has now become the clear leader in megawatt shipments.”

Other Chinese manufacturers are make up the majority of PV manufacturers. “When the final results become available over the next few weeks they are expected to show that Chinese tier-one manufacturers, including Yingli Green Energy, Trina Solar, Jinko Solar, Renesola, and Hanwha SolarOne broke their quarterly module shipment records in Q2’13,” NPD Solarbuzz said. The other Chinese PV manufacturers together produced 23 percent of the shipments.

The only U.S. company to ship a significant enough portion of the PV modules to single out is First Solar, which shipped 4 percent of the quarterly shipments. However, SunPower, also a U.S. company, was named among the top 20 PV manufacturers. The report also observed that the ratio of top manufacturers has been relatively consistent since the fourth quarter of 2011. “The leading solar PV suppliers are now starting to pull away from the pack, which provides strong evidence that the anticipated industry consolidation is finally in progress,” Lian said.

The manufacturers are also starting to change their shipping priorities. “Some module suppliers are prioritizing profitability over market share, resulting in only moderate shipment increases for [the second quarter of 2013]. Priorities for this subset of suppliers include downstream project expansions or market share gains in only premium-price regions,” according to Solarbuzz.

Japan is the highest growth market, the report found. That’s largely due to the country’s feed-in tariff, which was imposed as the country chose to move away from nuclear energy in response to the Fukushima disaster. There Canadian Solar and JA Solar are the leading PV imports. But the report also observed that over the past year Sharp Solar, Kyocera, Solar Frontier and Panasonic had 54 percent of the market share and the Japanese remain loyal to those and other Japanese PV manufacturers.