Explosive solar growth in India followed by stagnation over protectionism

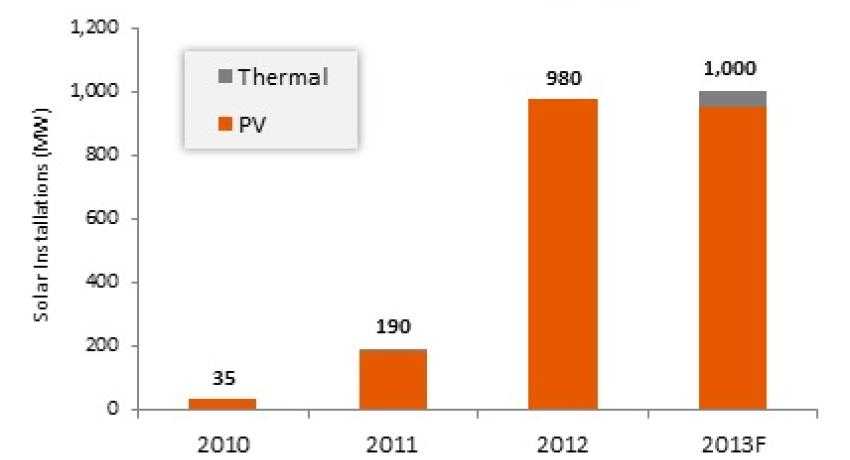

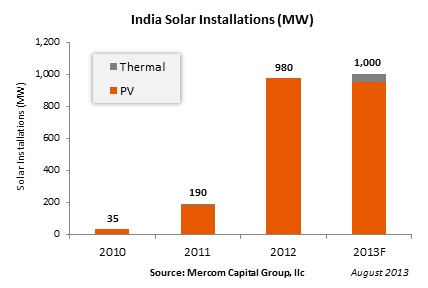

India’s solar market has exploded. In 2011 it had 190 megawatts of installed solar. Now there is more than 1.8 gigawatts of solar installed in the country. In fact, in the first seven months of 2013 India installed 622 megawatts of solar power—and it’s started to stall. The country has installed 73 megawatts in the last three months as the country has pursued anti-dumping and domestic content requirements.

India’s solar market has exploded. In 2011 it had 190 megawatts of installed solar. Now there is more than 1.8 gigawatts of solar installed in the country. In fact, in the first seven months of 2013 India installed 622 megawatts of solar power—and it’s started to stall. The country has installed 73 megawatts in the last three months as the country has pursued anti-dumping and domestic content requirements.

“The decisions made by India to pursue anti-dumping investigations and domestic content requirements (DCR) have all but paralyzed the sector,” said Raj Prabhu, CEO, Mercom Capital Group. “Nobody knows what is coming next. The Indian economy continues to face challenges with slow growth, high interest rates and a weak rupee, making life harder for solar developers,” he added in Mercom’s Indian Solar Quarterly Update.

Indian PV manufacturers have pushed the anti-dumping investigations and DCR, according to Prabhu. “Indian manufacturers see DCRs and anti-dumping tariffs as the only way to survive price competition.”

In pursing anti-dumping cases against imports India is following the tracks of the U.S. and more recently the E.U. Both the U.S. and E.U. implemented tariffs against Chinese PV imports, which the country and the continental organization found were being sold at uncompetitive prices in an attempt to grab market share. While the solar markets in both the U.S. and E.U. were strong enough to weather the tariffs that were implemented—and the tariffs were done in such a way that Chinese manufacturers could skirt most tariffs—it seems the prospect of anti-dumping and DCR has halted progress in India.

But, perhaps given that India has come quicker and later into the solar industry, the history of solar that U.S. and E.U. have isn’t there. So there isn’t necessarily the network of established solar installers and developers there. Indeed, Prabhu observed, “Unlike manufacturers, Indian project developers are not as well organized and lack a unified voice and leverage, something that is sorely needed when it comes to policy decisions.”

Installers and developers said domestically produced materials would be easier to procure. “However, they claim that local manufacturers do not provide the kind of warranties to back up their products that come with European and American panels,” Prebhu said. Neither can India’s PV manufacturers match the price and efficiency of modules from other countries, he added.

Prabhu also points out to shifts in the solar industry that are impacting the market. “The fundamentals of the solar sector have shifted. After years of panel price drops, module prices have gone up this year by about 10 percent, while the rupee has fallen about 9 percent. As this occurs, policy, with all its changes and delays, has not been able to keep up with the rapidly changing solar market environment,” he said.

“With the government desperately looking to attract foreign direct investments due to deteriorating economic conditions, India is sending the wrong message to investors with the anti-dumping case and DCRs,” Prabhu said. He said the government should develop long-term solar policy and a growth roadmap.