Venture capital investments in solar continue to flag, other solar investments pick up

The most recent report from Mercom Capital Group shows that on a quarter over quarter basis investment was up from the first quarter, but still significantly lower—almost half—compared to the same quarter last year.

The most recent report from Mercom Capital Group shows that on a quarter over quarter basis investment was up from the first quarter, but still significantly lower—almost half—compared to the same quarter last year.

The lack of solar venture capital funding in the industry could mean that potentially important new technologies or equipment advances aren’t seeing funds that could help bring them to the marketplace quicker. “With solar technology companies struggling, investments have been going to downstream companies,” said Raj Prabhu, CEO of Mercom Capital Group. “That said, investments into solar technology companies haven’t completely dried up. Small venture rounds are still going to several niche technology companies instead of the larger deals that were typical for thin film, CSP and CPV companies.”

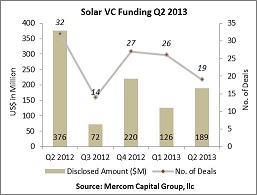

The investment numbers are looking up compared to the first quarter of 2013. The report found that $189 million was invested in 19 deals in this year’s second quarter. The first quarter ultimately saw more deals, 26, but only $126 million in investments. But on a year-over-year basis, the second quarter pales in comparison to last year’s second quarter, which saw $376 million in venture capital funding in 32 deals for the solar industry.

“Solar downstream companies received most of the funding with $128 million,” Mercom reported. The two largest deals Mercom reported, for instance, were the $69 million raised by Chinese solar developer Hefei Golden Sun Energy Technology and the $42 million raised by Clean Power Finance to support its operations and software platform.

While venture capital is an important part of solar investing, particularly for the future of solar, it’s only a fraction of the total investments in the solar sector. Overall corporate funding for the solar sector was $915 million in the quarter. In addition, to support the continual growth of third-party financing options solar leasing and power-purchase agreement companies disclosed they raised a record $1.33 billion. “The strongest quarter ever for solar lease funds, with the total amount raised in the first six months almost equivalent to all of the solar lease funds raised last year,” Mercom said.

Mergers and acquisitions in the solar industry were also strong suggesting that the solar industry is maturing somewhat and companies falling by the wayside are finding purchasers. In all, Mercom reported 18 deals totaling $1.27 billion during the quarter. “Themes emerging out of this quarter’s M&A activity included: consolidation in the inverter market, strategic acquisitions, and acquisitions of distressed assets/companies,” it said.