Nearly 200 solar manufacturers may go out of business—soon

That’s not a small number, but with intense competition, lower and fading incentive programs around the world and the “China factor”, a new report from GTM Research suggests that will be the case. The report anticipated that roughly 180 solar makers around the globe will go out of business or be consolidated by 2015.

That’s not a small number, but with intense competition, lower and fading incentive programs around the world and the “China factor”, a new report from GTM Research suggests that will be the case. The report anticipated that roughly 180 solar makers around the globe will go out of business or be consolidated by 2015.

The new report, Global PV Module Manufacturing 2013: Competitive Positioning, Consolidation and the China Factor, anticipated that the biggest impacts will be felt in countries with high-costs, the number thin-film manufacturers will continue to shrink, and China will continue to dominate the PV manufacturing world, though some consolidation and company failures are expected there, too. “We think the number of active facilities in high-cost locations is expected to reduce drastically over the next couple of years,” said report author and GTM Research Senior Analyst Shyam Mehta.

While low-cost places for manufacturing, like China are also expected to see some failures and consolidations, it will continue to gain marketshare. “We certainly don’t think Chinese dominance is going to change,” he said.

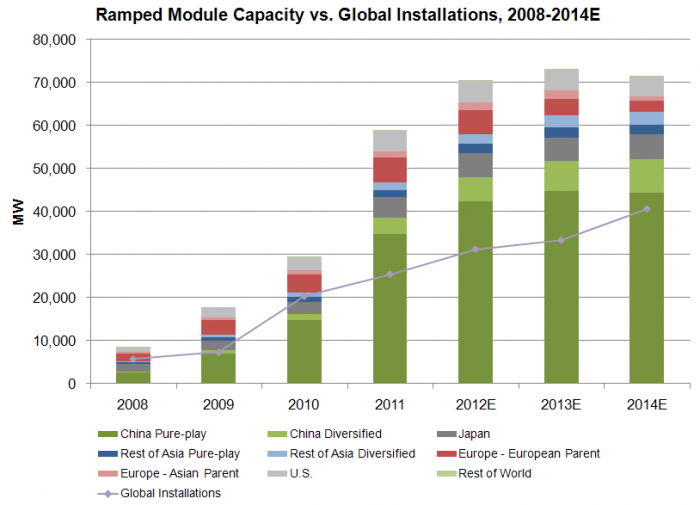

The industry is suffering in part because of it’s own success in the past few years. That’s partly because of an overly aggressive capacity build-up in 2010 and 2011, according to the report. But also because feed-in tariff subsidies in major markets like Germany are quickly being drawn down. Together they created the massive industry imbalance with production well exceeding demand, an issue the report anticipated will not resolve until—at least—2014, it said.

The oversupply and incentive drops mean that more manufacturers are competing for fewer sales, which is forcing companies to shutter plants. “In 2011 the number of active facilities we track in these high-cost locations, Europe, the U.S., other high cost locations like japan [continued to shrink],” Mehta said. In the near future PV manufacturing in such places could fall to 9 percent of the global production capacity. He also anticipated that some of those plants will only be satellites of offshore companies and will be in key locations.

But other manufacturers, particularly European manufacturers, could fail or be bought up by asian manufactures. “By doing so, Asian firms such as Microsol, Hanwha and Aiko Solar hope to access the strong brand and channel penetration of their acquisitions to gain an edge in European markets,” Mehta said in an article about the report.